We are living in a time of increasing social needs combined with the greatest inequality in global wealth and the generosity of the givers is just not keeping pace. Philanthropists play a tremendous role in addressing this, but they need to be smarter and cutting-edge innovative philanthropy has never been so important to put limited resources to the best use. In philanthropy, innovation means the development of a new product, process or approach to enable funds to be given or invested more wisely or more easily. Innovation is occurring at great pace in all walks of life, and the philanthropy sector is no exception. The landscape is constantly changing, with new tools, vehicles and approaches being developed, tested, refined and implemented around the world. Philanthropic foundations exist partly as a form of a growing movement to channel private funding to the public good in innovative ways.

New players in the philanthropy field are also responsible for innovative thinking. While there has been an increasing professionalization of those working in the sector, innovation itself is being driven by the recent wealth creators turning their hand to social problems, and a younger generation of philanthropists doing things differently from their predecessors and it’s not just happening within the non-profit sector—some of the new initiatives are emerging from the private sector too. There’s a risk that traditional philanthropy may miss the boat if it doesn’t embrace innovation more, as new players set the pace and see traditional models as increasingly irrelevant.

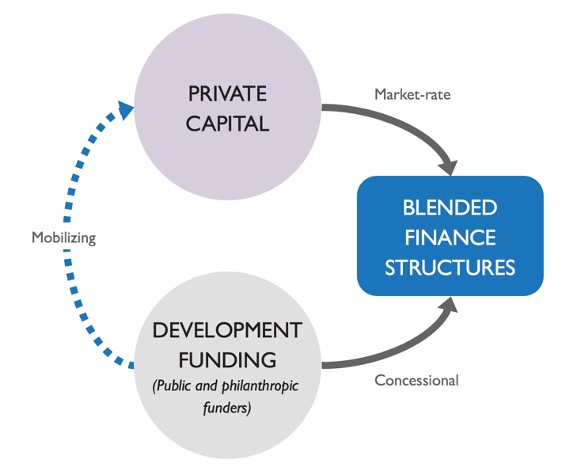

Notable in the East Africa region is the increase in local giving and the growth of various channels of giving. One of these innovative ways being presented to Foundations and Trusts is Blended Finance, understood as the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development. It is a structuring approach that allows organizations with different objectives to invest alongside each other while achieving their own objectives (whether financial return, social impact, or a blend of both). The main investment barriers for private investors addressed by blended finance are:

(i) High perceived as risky and (ii) Poor returns for the risk relative to comparable investments. Blended finance creates investable opportunities in developing countries which leads to more development impact.

Convergence focuses on blended finance in developing countries. Developing countries face significant challenges including low levels of access to safe drinking water, sanitation and hygiene; energy poverty; high levels of pollution; high rates of tropical and infectious diseases; and a lack of physical infrastructure. Blended finance can create investment opportunities in developing countries, crowding in additional private sector funds in volumes never before seen.

Convergence focuses on blended finance to catalyze private investment. Other important stakeholders and initiatives, such as the Organization for Economic Co-operation and Development(OECD) and the DFI Working Group on Blended Concessional Finance forPrivate Sector Projects focus on a broader scope of blended finance that includes the use of development capital to mobilize commercial-development orientated public capital (e.g., capital from development finance institutions). Convergence works closely with theOECD, DFI Working Group, and others to coordinate blended finance activity

There are a number of characteristics of blended finance, but the following three signature characteristics:

- The public and/or philanthropic parties are catalytic. The participation from these parties improves the risk/return profile of the transaction in order to attract participation from the private sector.

- The transaction contributes towards achieving the SDGs. However, not every participant needs to have that development objective. Private investors in a blended finance structure may simply be seeking a market-rate financial return.

- Overall, the transaction expects to yield a positive financial return. Different investors in a blended finance structure will have different return expectations, ranging from concessional to market-rate.

In conclusion, Blended Finance has the potential to transform how foundations are dealing with their investments, dramatically increasing the potential of creating social impact and supporting the achievement of the SDGs from money that is currently invested through this innovative model of financing.